How Animals Risk Security (LRP) Insurance Policy Can Secure Your Livestock Financial Investment

Animals Danger Defense (LRP) insurance coverage stands as a reliable guard versus the uncertain nature of the market, providing a tactical approach to guarding your assets. By diving into the complexities of LRP insurance and its multifaceted advantages, animals manufacturers can strengthen their financial investments with a layer of security that goes beyond market variations.

Understanding Livestock Threat Security (LRP) Insurance

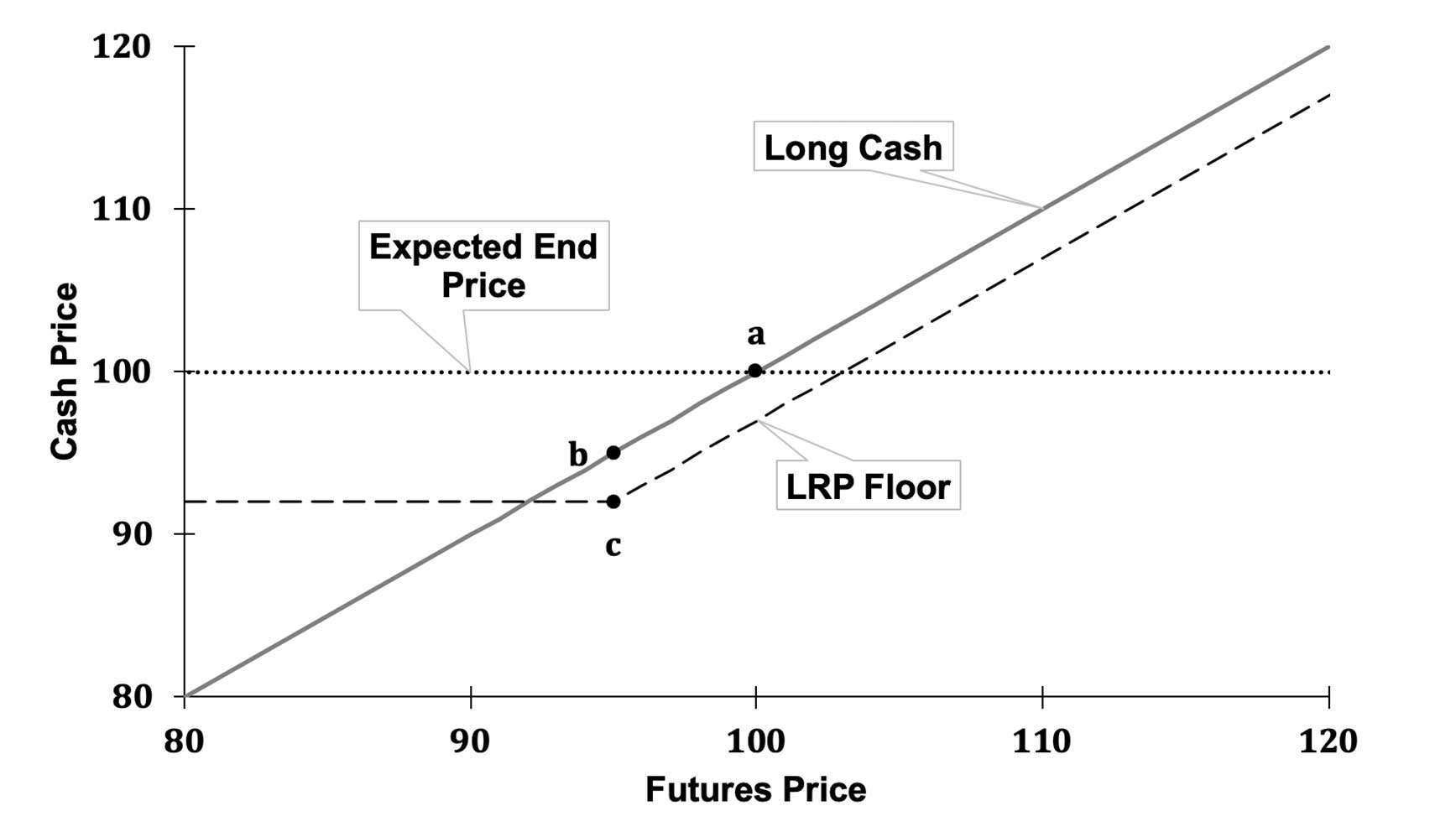

Recognizing Animals Danger Security (LRP) Insurance policy is vital for livestock producers looking to mitigate monetary risks related to rate fluctuations. LRP is a federally subsidized insurance product designed to protect producers against a decline in market prices. By giving insurance coverage for market price declines, LRP assists manufacturers secure a floor cost for their animals, making certain a minimal level of profits no matter market variations.

One secret element of LRP is its flexibility, allowing manufacturers to tailor insurance coverage levels and plan sizes to fit their particular needs. Producers can select the variety of head, weight array, insurance coverage cost, and insurance coverage duration that align with their manufacturing goals and run the risk of tolerance. Understanding these customizable alternatives is vital for manufacturers to effectively manage their cost danger direct exposure.

In Addition, LRP is readily available for various animals kinds, consisting of livestock, swine, and lamb, making it a flexible danger administration device for animals producers across different fields. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make enlightened choices to guard their financial investments and make sure monetary stability when faced with market unpredictabilities

Benefits of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Animals Danger Protection (LRP) Insurance policy gain a critical advantage in protecting their investments from cost volatility and protecting a steady financial ground in the middle of market unpredictabilities. By setting a floor on the cost of their livestock, manufacturers can alleviate the danger of significant financial losses in the event of market downturns.

Furthermore, LRP Insurance gives manufacturers with peace of mind. In general, the advantages of LRP Insurance coverage for livestock manufacturers are substantial, providing a useful device for taking care of threat and guaranteeing economic security in an uncertain market setting.

Exactly How LRP Insurance Policy Mitigates Market Risks

Alleviating market risks, Livestock Threat Defense (LRP) Insurance offers animals manufacturers with a trustworthy guard against cost volatility and financial unpredictabilities. By offering security against unforeseen cost drops, LRP Insurance assists producers safeguard their investments and keep monetary security when faced with market changes. This kind of insurance permits livestock manufacturers to secure a price for their animals at the beginning of the policy period, guaranteeing a minimal price degree despite market modifications.

Steps to Safeguard Your Livestock Investment With LRP

In the world of agricultural risk monitoring, carrying out Livestock Danger Security (LRP) Insurance entails a tactical procedure to guard investments versus market variations and uncertainties. To safeguard your animals investment properly with LRP, the very first step is to analyze the details risks your operation deals with, such as cost volatility or unforeseen weather condition events. Comprehending these threats permits you to establish the insurance coverage degree required useful content to shield your investment adequately. Next, it is critical to research and select a credible insurance coverage provider that provides LRP policies tailored to your animals and service demands. When you have chosen a company, meticulously examine the plan terms, problems, and protection limitations to ensure they straighten with your threat administration goals. Furthermore, on a regular basis keeping track of market patterns and changing your insurance coverage as required can help optimize your defense against potential losses. By complying with these steps diligently, you can enhance the safety of your livestock investment and navigate market unpredictabilities with confidence.

Long-Term Financial Safety And Security With LRP Insurance

Guaranteeing sustaining financial stability through the usage of Livestock Risk Security (LRP) Insurance coverage is a prudent long-lasting approach for farming manufacturers. By including LRP Insurance policy right into their threat management plans, farmers can safeguard Check Out Your URL their animals financial investments against unanticipated market variations and adverse events that can threaten their monetary health with time.

One trick advantage of LRP Insurance policy for long-lasting monetary security is the tranquility of mind it uses. With a trustworthy insurance plan in area, farmers can minimize the economic dangers connected with volatile market conditions and unexpected losses because of elements such as condition outbreaks or all-natural catastrophes - Bagley Risk Management. This security enables manufacturers to concentrate on the daily operations of their animals business without continuous fret about prospective economic setbacks

Moreover, LRP Insurance offers a structured technique to managing danger over the long-term. By setting certain coverage levels and picking suitable endorsement durations, farmers can customize their insurance policy prepares to line up with their monetary goals and take the chance of tolerance, making certain a safe and sustainable future for their livestock operations. To conclude, purchasing LRP Insurance coverage is a positive technique for farming producers to accomplish long lasting monetary security and shield their livelihoods.

Final Thought

In conclusion, Animals Threat Security (LRP) Insurance is a valuable tool for livestock manufacturers to alleviate market dangers and secure their investments. By understanding the advantages of LRP insurance and taking actions to implement it, producers can attain lasting monetary security for their operations. LRP insurance supplies a security internet versus price changes and makes sure a level of security in an unforeseeable market environment. It is a sensible selection for protecting livestock financial investments.

Comments on “Opening Growth Possible: Bagley Risk Management Approaches”